Why Encourage Students to Take on Crippling Debt in Pursuit of Degrees That Don't Even Provide the Earning Potential to Pay it Off?

We're creating an uber-debt ridden population in order to support an uber-wealthy class and maintain the largest economic inequality in our nation's history, and we're doing it through our higher-educational system. How? We're graduating students leveraged to the hilt, who either can't get a job, or if they're lucky enough to find employment, make just enough to pay off their debt. In other words, they are indentured servants, who can't save or build for their futures, who cannot become entrepreneurs, who, in a nutshell, cannot serve broader society because they must follow the almighty dollar first and foremost. Moreover, this albatross of debt impacts on the ability to start families, because, as we know, children are expensive!

This is not just a problem for young people. Many parents take out parent plus loans to support their kids. Some have to go back to college to change careers and take out loans when they're in their 40's and 50's, especially now when jobs are scarce. They can look forward to having their social security garnished.

“About twice as many Social Security recipients are not receiving all of their Social Security payments this year because they have unpaid federal student loans, according to a report by SmartMoney.com.Yet, not going to college is not an option for many young people. In fact, too many parents/teachers/friends insist that getting the "best education" at the "best schools" no matter what the cost, is absolutely necessary to that young person's future. The problem is most--parents/teachers/friends and students, alike-- do not consider the long-term consequences of accumulating life-long debt.. They do not consider that student loans cannot be discharged in bankruptcy. Instead, our young people are given a rosy prognosis when choosing schools and told not to worry about the future with easy to qualify for loans.

According to a 1996 law, the federal government has the authority to withhold portions of Social Security payments if defaulted debt is owed to the government, including federal student loans.

“It’s quite extraordinary because normally Social Security benefits can’t be touched by creditors,” said Deanne Loonin, a staff attorney with the National Consumer Law Center.

From January through August 6 of this year, the government reduced the size of about 115,000 retirees’ Social Security checks, almost double the department’s enforcement in 2011, according to data from the Treasury Department. In 2007, there were 60,000 cases and in 2000, there were only six cases.

Universities are now corporatized. The parasitic corporate model of inflated infrastructure and bureaucracy that rewards elite executives with enormous salaries and squeezes everyone else, making them jump through endless bureaucratic hoops. Between the ever-increasing growth of administrative expenditures--huge amounts devoted to funding unnecessary administrative positions--and government subsidized institutions, colleges and universities have no incentive to reduce cost.

“U.S. universities employed more than 230,000 administrators in 2009, up 60 percent from 1993, or 10 times the rate of growth of the tenured faculty, those with permanent positions and job security, according to U.S. Education Department data.

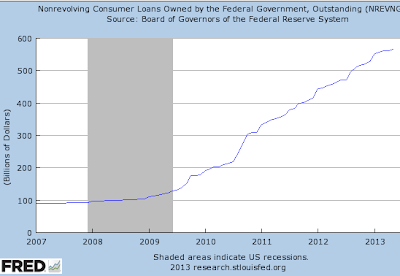

Spending on administration has been rising faster than funds for instruction and research at 198 leading U.S. research universities, concluded a 2010 study by Jay Greene, an education professor at the University of Arkansas."There is about $1.2 trillion in student loans outstanding with all but 15% of that owned or guaranteed by the government. The chart below shows the student loan amount held directly by the federal government., rising at about $110 billion per year.

“The Obama administration is forecast to turn a record $51 billion profit this year from student loan borrowers, a sum greater than the earnings of the nation’s most profitable companies and roughly equal to the combined net income of the four largest U.S. banks by assets.”Learning to live below one's means and gaining the ability to distinguish between "needs" and "wants" might be the only way out.

0 comments:

Post a Comment